Frequently Asked Questions

Navigating the real estate market can be daunting, but we're here to help clarify any uncertainties you may have. Below, we've compiled some of the most common questions to guide you through the process.

Do I need a realtor to buy or sell a home?

While not required, a realtor provides expertise in pricing, negotiations, contracts, and market trends, ensuring a smoother and often more profitable transaction.

What should I look for in a real estate agent?

Look for experience, market knowledge, strong communication skills, and positive client reviews. A good agent should understand your needs and work in your best interest.

How do I start the home-buying process?

Start by getting pre-approved for a mortgage to determine your budget. Then, work with a realtor to find homes that fit your needs and negotiate the best deal.

When is the best time to sell my home?

Spring and summer are generally the best times, as more buyers are actively looking. However, the right time depends on market conditions and your personal situation.

What is a home valuation?

A home valuation is an assessment of your property's worth based on various factors, including location, condition, and recent sales of similar homes in your area. It helps you understand how much your home could sell for in the current market.How is my home valued?

Home valuations are typically conducted by real estate professionals who analyze market trends, property features, and comparable sales. They may also consider the condition of your home and any upgrades or renovations you've made.How much do I need for a down payment?

It depends on the loan type, but conventional loans typically require 5-20%, while FHA loans allow as little as 3.5% down. VA and USDA loans may require no down payment.

What is a seller’s vs. a buyer’s market?

A seller’s market happens when demand exceeds supply, leading to higher prices and faster sales. A buyer’s market occurs when supply exceeds demand, giving buyers more negotiation power.

What are closing costs?

Closing costs are the expenses, over and above the asking price of the property, that buyers and sellers normally incur to complete a real estate transaction. Costs incurred may include loan origination fees, title searches, title insurance, surveys, taxes, deed-recording fees, and credit report charges. Prepaid costs are those that recur over time, such as property taxes and homeowners' insurance. The lender is required by law to state these costs in a "good faith estimate" within three days of a home loan application. Typically these costs will range between 2% and 3% of the mortgage amount.

How long does it take to buy a home?

The process usually takes 30-60 days from offer acceptance to closing, but finding the right home can take weeks or months, depending on the market.

Should I get a home inspection?

Yes! A home inspection helps identify potential issues before you buy, giving you the opportunity to negotiate repairs or back out if needed.

How long does it take to sell a home?

It varies based on market conditions, but homes typically sell within 30-90 days. Pricing competitively and staging your home can help speed up the process.

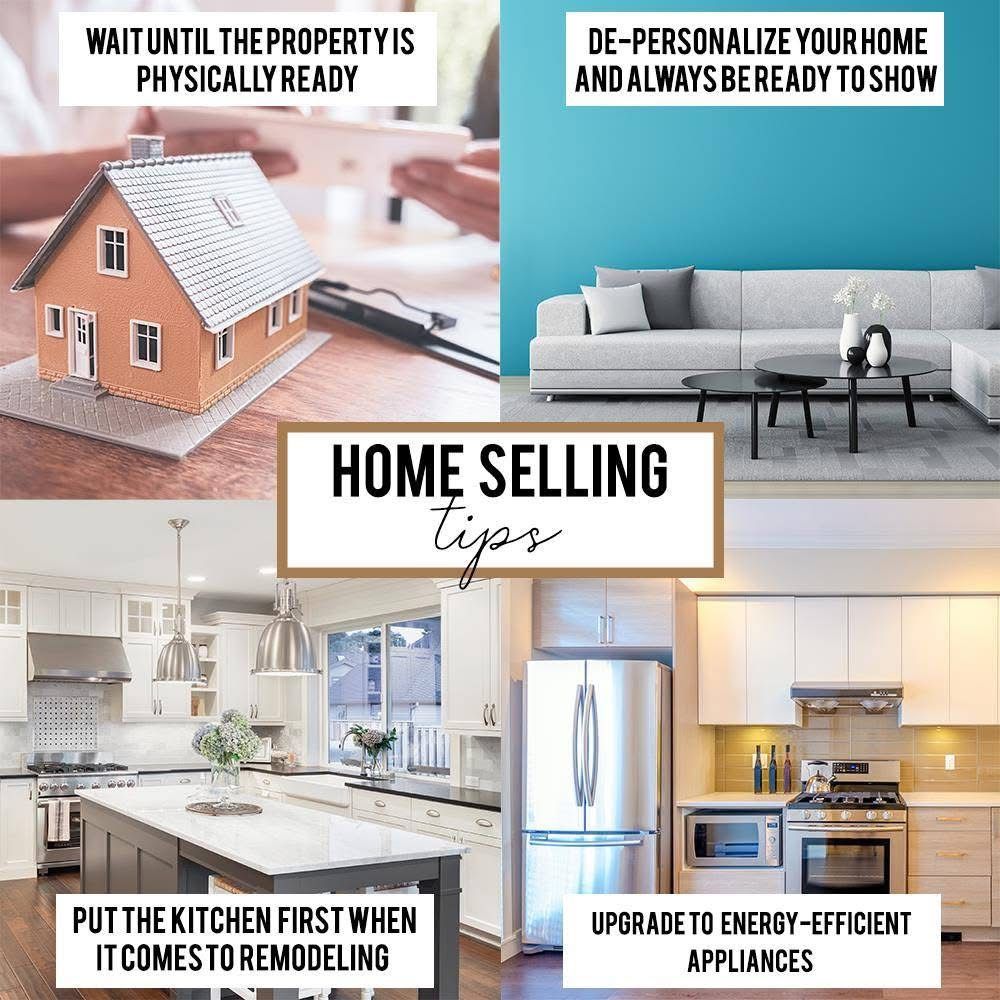

Should I make repairs before selling my home?

Small updates like fresh paint, fixing minor issues, and decluttering can increase your home’s appeal. Major renovations depend on your return on investment.

What is earnest money, and do I get it back?

Earnest money is a deposit made to show a buyer’s commitment. If the deal closes, it goes toward the down payment. If the buyer backs out for an approved reason (like a failed inspection), they may get it back.

What is escrow?

Escrow is a neutral third party that holds funds and documents until the transaction is complete, ensuring all terms are met before closing.

What happens on closing day?

On closing day, buyers and sellers sign final documents, funds are transferred, and ownership of the property is officially transferred to the buyer.

Still Have Questions?

Tips and Tricks

Discover expert tips and insider tricks to help you buy, sell, and invest in real estate with confidence and success.

8 THINGS TO AVOID IN YOUR QUEST TO BUY A HOUSE

With your dream home under contract, most of the hard work is done. However, there are still some things to avoid to ensure there are no delays in your journey to home ownership.

- Don't apply for a new credit card

- Don't buy a new car

- Avoid changing jobs

- Don't move money without a paper trail

- Don't close any credit accounts

- Don't spend your savings

- Don't close any credit accounts

- Don't furnish the home before you own it